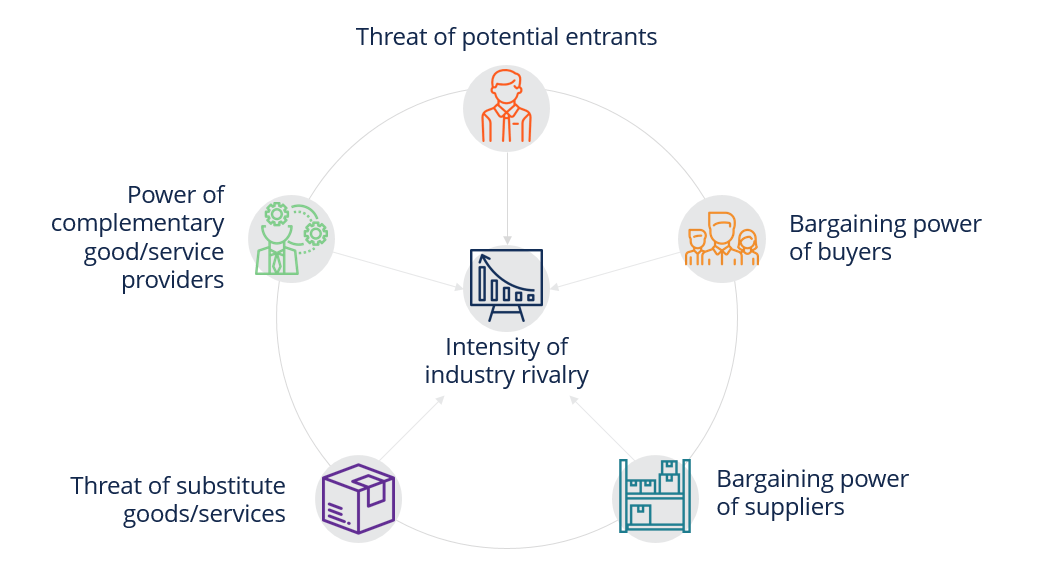

Industry Rivalry

This element is especially significant for Samsung as the other White Goods multinationals like LG, Nokia, and Motorola not to mention Apple are engaged in fierce competitive rivalry. Indeed, Samsung cannot take its position in the market for granted as all these and other domestic white goods players operate in a market where margins are tight and the competition is intense. Apart from this, Samsung faces the equivalent of the “Cola Wars” (the legendary fight for dominance between Coke and Pepsi) in emerging markets like India where Samsung has to contend and compete with a multitude of players domestic and global. This has made the impact of this dimension especially strong for Samsung.

This element is especially significant for Samsung as the other White Goods multinationals like LG, Nokia, and Motorola not to mention Apple are engaged in fierce competitive rivalry. Indeed, Samsung cannot take its position in the market for granted as all these and other domestic white goods players operate in a market where margins are tight and the competition is intense. Apart from this, Samsung faces the equivalent of the “Cola Wars” (the legendary fight for dominance between Coke and Pepsi) in emerging markets like India where Samsung has to contend and compete with a multitude of players domestic and global. This has made the impact of this dimension especially strong for Samsung.Barriers to Entry and Exit

The White Goods industry is characterized by high barriers to entry and low barriers to exit especially where global conglomerates like Samsung are concerned. Indeed, it is often very difficult to enter emerging markets because a host of factors have to be taken into consideration such as setting up the distribution network and the supply chain. However, global conglomerates can exit the emerging markets easily as all it takes is to handover and sell the business to a domestic or a foreign player in the case of declining or falling sales. This means that Samsung has entered many emerging markets through a step-by-step approach and has also exited the markets that have been found to be unprofitable. This is the reason why white goods multinationals like Samsung often do their due diligence before entering emerging markets.

Power of Buyers

The power of buyers for white goods makers like Samsung is somewhat of a mixed bag where though the buyers have a multitude of options to choose from and at the same time have to stick with the product since they cannot just dump the product, as it is a high value item. Further, the buyers would have to necessarily approach the companies for after sales service and for spare parts. Of course, this does not mean that the buyers are at the mercy of the companies. Far from that, they do have power over the companies, as most emerging market consumers are known to be finicky when deciding on the product to buy and explore all the options before reaching a decision. This means that both the buyers and the companies need each other just like the suppliers and the companies, as we shall discuss next.

Power of Suppliers

In many markets in which Samsung operates, there are many suppliers who are willing to offer their services at a discount since the ancillary sectors are very deep. However, this does not mean that the companies can exert undue force over the suppliers as once the supply chain is established; it takes a lot to undo it and build a new supply chain afresh. This is the reason why white goods makers like Samsung invariably study the markets before setting up shop and also take the help of consultancies in arriving at their decision.

Threat of Substitutes

This element is indeed high as the markets for white goods are flooded with many substitutes and given the fact that consumer durables are often longer term purchases, companies like Samsung have to be careful in deciding on the appropriate marketing strategy. This is also the reason why many multinationals like Samsung often adopt differential pricing so as to attract consumers from across the income pyramid to wean them away from cheaper substitutes. Further, this element also means that many emerging market consumers are yet to deepen their dependence on white goods and instead, prefer to the traditional forms of housework wherein they rely less on gadgets and appliances. However, this is rapidly changing as more women enter the workforce in these markets making it necessary for them to use gadgets and appliances.

Stakeholders

This is an added element for analysis as the increasing concern over social and environmentally conscious business practices means that companies like Samsung have to be careful in how they do business as well as project themselves to the consumers. For instance, white goods makers are known to decide after due deliberation on everything from choosing their brand ambassadors to publicizing their CSR (Corporate Social Responsibility) initiatives.

Conclusion

As the diagram above indicates the relative strengths and the weaknesses of each element, we can now conclude this analysis with the theme that as the global economy integrates and more emerging markets open up, companies like Samsung are at an advantage because they have already established themselves in many markets. However, it must also be noted that each market is unique and hence, Samsung must not adopt a one size fits all strategy and instead, must approach each market differently. In conclusion, Samsung can take pride from the fact that being an Asian conglomerate, it has managed to break into and hold its own against many western multinationals that have been in this business for decades.